Strategy Design

ETH Portfolio Strategy

Introduction

This strategy aims to earn ETH by building a portfolio with ETH-derivative assets, including through ETH options trading, Liquity arbitrage, and yield farming. Risk-reward balance is achieved by portfolio theory using diversification and efficient frontier methods. We balance the risk and return by manipulating the weight of each strategy in the portfolio, targeting a 15% return with a 5% risk.

Options Trading

We sell ETH European covered calls on Ribbon Finance on a weekly basis and hedge the position on GMX. In this section, we discuss the pricing method and introduce our delta-neutral hedging method.

Model

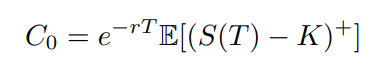

A common model for European options is the Black-Scholes model, which can be formulated as:

where C_0 is the option price, T is the expiration period, S(t) is the underlying asset price at time t, K is the strike price, and r is the risk-free interest.

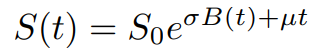

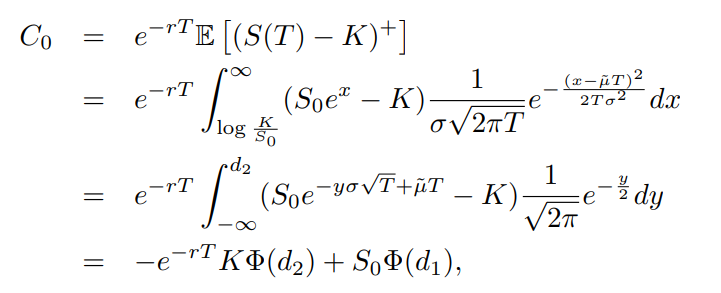

Assume that the asset price follows geometric Brownian motion, i.e.,

where B(t) is the standard Brownian process, then the fair price of the option can be derived by:

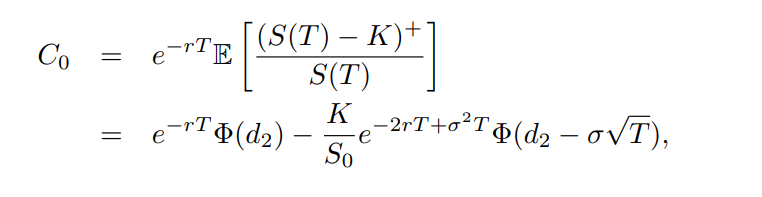

Covered Call in ETH

Ribbon Finance sells ETH covered calls with ETH, so we need to consider the price of ETH when calculating the price C_0:

Delta-Neutral Hedge

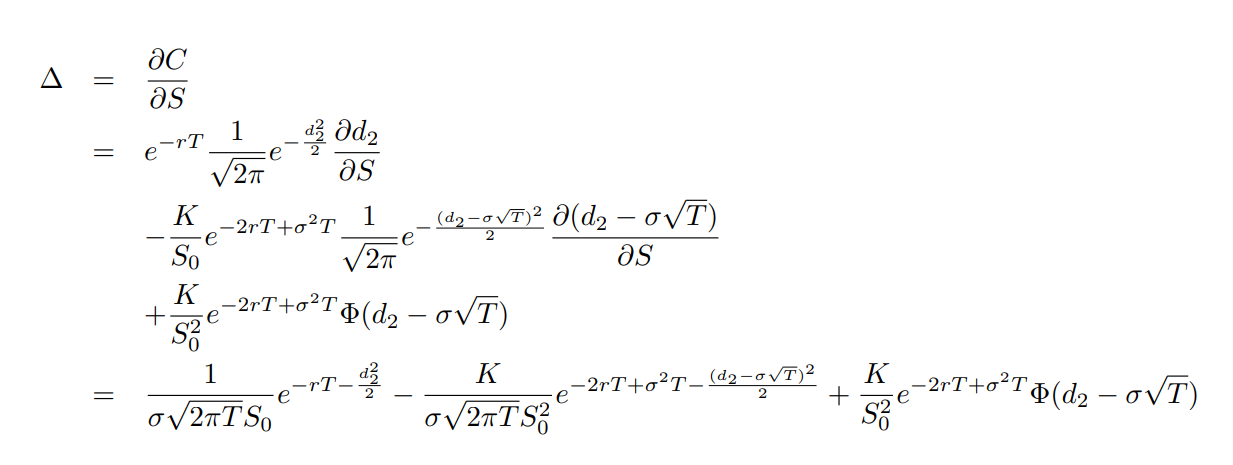

To calculate the delta of the call option, we differentiate the option price with respect to the ETH price:

Strategy

We sell the covered call and calculate the delta of the position. If the delta is smaller than a certain threshold, we will open a long position on GMX to make it delta-neutral. Then, we periodically recalculate the delta and adjust the long position after a given time interval.

Liquity Arbitrage

Liquity is a 0%-interest-rate lending protocol, where one can use ETH as collateral to borrow LUSD, a stablecoin. Due to the $110%$ collateral ratio and its redeem function, the price of LUSD is volatile around $1 but does not depeg. We conduct LUSD/USDC arbitrage by setting the arbitrage price range. When the price is out-of-range, there is an arbitrage opportunity. When the price is within range, we stake LUSD into the stability pool on Liquity to earn yield.

Arbitrage Price Range

We analyze LUSD/USDC price and determine the arbitrage price range using recent pricing data. The length of the recent pricing data is selected by cross-validation.

Yield Farming

We deposit ETH into lending protocols to earn interest. In addition, the ETH reserved for covered call hedging and maintaining collateral ratio on Liquity is also used for yield farming.

Last updated